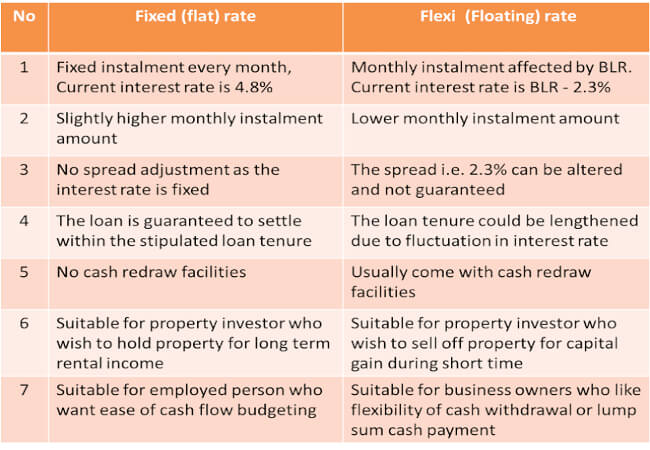

All you need to do is share a couple of basic details regarding on your own and recognize your pre-approved offer. Term loans are generally subject to a fixed rate of interest, with passion being charged on the entire loan quantity, whether the quantity gets used or not. This lowers the EMIs, thereby helping you to manage your financial resources effortlessly. This makes the loan extra adaptable than loans with a fixed term.

- Your motivation and also constant feedback on just how to boost our offering have actually just made our resolve as well as commitment to these suitables stronger.

- Furthermore, you don't have to promise any type of possession to get approved for it.

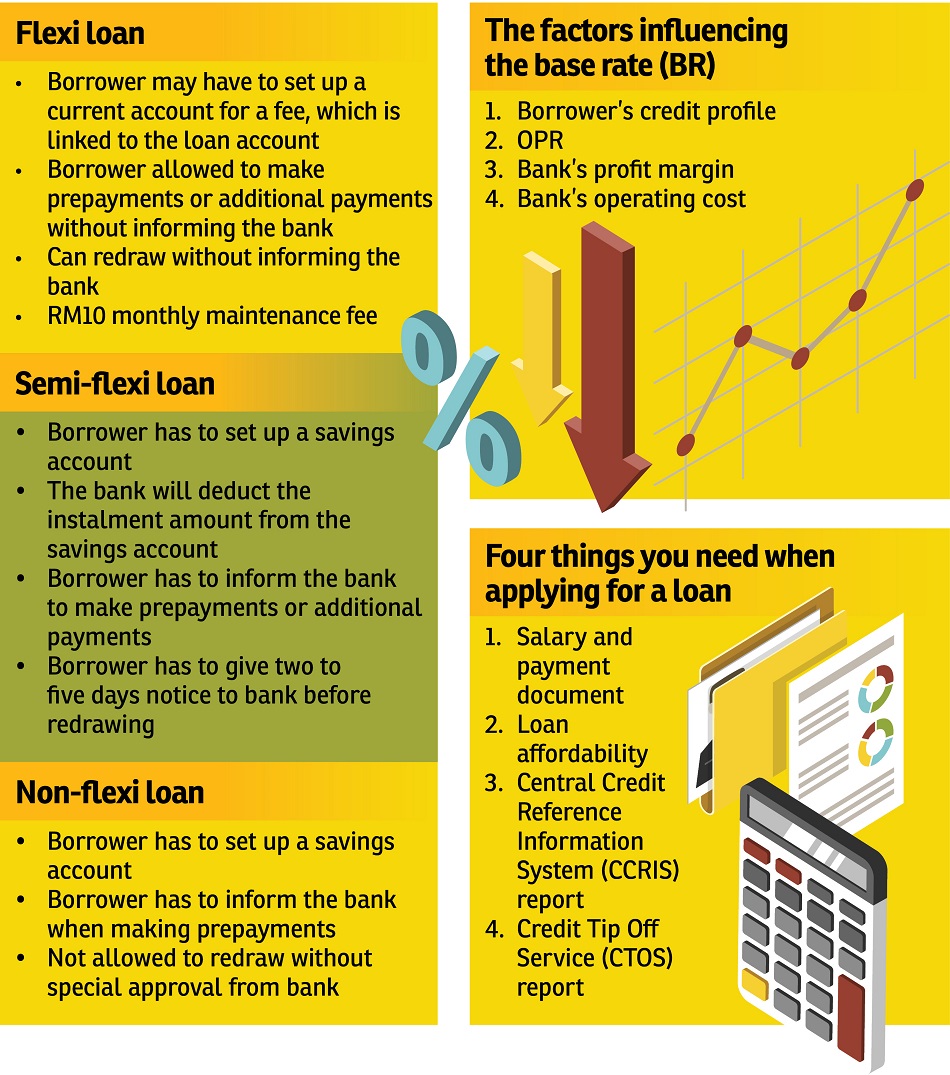

- A flexi home loan supplies you upsides on both great as well as stormy days.

In this manner, you have extra control over your web interest outgo and can optimize your borrowing approach. You can make part-prepayments online using Experia, the client site. A flexi mortgage uses you advantages on both good and also wet days.

Again, you have the alternative to either make component early repayments towards the major quantity as and also when your monetary circumstance enables you to do so, or you can choose bullet settlement. You can quickly convert your individual lending into a flexi car loan by contacting your lender. Most of the lenders transform the finance at the same rates of interest, nonetheless talk to your lending institution for the exact same.

What Are Flexi Car Loans & Exactly How Are They Beneficial For Small Business?

Please consider your private conditions prior to getting a Westpac Personal Car Loan. Transfer funds from the approved Bajaj Financing over-limit car loan limit to your lending account online. Obtain Bajaj Finserv Personal Finance if you need fast cash money for family members, health and wellness, education and learning, travel, service or more.

FlexiLoans gives versatile settlement choices with weekly or monthly EMI payments and interest is billed beginning with 1% monthly of the funding quantity. Flexi personal car loan is a good alternative as you can manage your funds with flexibility and also some loan providers additionally provide instantaneous flexi loans. Flexi funding includes advantages like lower EMI's, adaptable settlement of lending partially, lending quantity disbursed immediately, requires minimal paperwork etc

Accessibility Of Funds Remains In All Times

Car loans are suggested for monetary flexibility, and also you should only borrow when you require the amount. Bajaj Finserv Personal Loans for Financial debt Consolidation is developed to ease the customers of built up debt mountain. Here, you can obtain a Personal Funding as a Loan consolidation Finance as well as handle the settlement by combining existing financings into one. Training is a worthy profession, and by extending personalized fundings for Teachers, Bajaj Finserv has actually moved a step ahead of its competition.

. You might likewise obtain flexi personal finances offline by seeing the branch of your recommended financial institution as well as filling out an application. The offline application treatment is similar to the on-line application process-- complete an application and submit your records, to name a few things. Term fundings typically have a rigorous authorization process that needs a good deal of documentation.

You also have an alternative to get additional funds by availingTop up loanon your existing personal car loan without much problem. There might be an impact that attempting to take out from a lending account might be cumbersome as well as potentially will take a very long time to process prior to you see the actual money. The truth is, with Flexi Home Loan accounts, it's just as simple as managing an interest-bearing account. You can transfer and also relocate funds with usual platforms such as electronic banking and ATM. You will not have to fill out a stack of kinds, go through an extensive approval process simply to access your money.

A term finance is usually expanded by a loan provider for a period with an agreed-upon payment timetable based on a set rate of interest. Flexi individual lendings allow you the adaptability to withdraw the quantity you need from your approved lending limit, as many times you want, and as and when a demand develops. Here, you can likewise settle the car loan as and also when you have additional cash money. Services can obtain car loans beginning with Rs. 50,000 to Rs. 1,00,00,000 for short tenures approximately 2 years.

The amount of car loan that can be availed as organization finance or term funding of FlexiLoans is a minimum of Rs. 50,000 as well as optimum Rs. 1,00,00,000. You can choose the financing based on your demands, monetary capabilities as Click to find out more well as other such factors as well as opt for the one that works ideal for you. With a much better understanding of these individual lending variants, you can make an informed choice that assists you handle your funds much better. Hybrid Flexi Car Loan, just the quantity you desire to make use of obtains disbursed right into your bank account. This provides you total accessibility to your financing as well as the loan quantity you're reliant pay. You can utilize the financing for any function, as well as the rate of interest is billed only on the amount you desire to utilize.