The loan needs to cover the home and the land on which it stands. The house should be cruise timeshare categorized as realty, however not always for state tax purposes. The home should be built and stay on a permanent chassis. Deposits on a Title II loan can go as low as 3. 5 percent, and terms can go as long as thirty years. Some lending institutions use Fannie Mae home mortgages to borrowers who want to finance a produced home through the MH Advantage program. To qualify, you will require to please a variety of eligibility criteria, including installing the house with a driveway and a walkway that links the driveway, carport or detached garage.

The loans featured 30-year funding, and you may have wesley group the ability to secure them with a deposit as low as 3 percent (Trade credit may be used to finance a major part of a firm's working capital when). As an included advantage, rates of interest on MH Benefit mortgages tend to be lower than those of most traditional loans for manufactured homes. Customers who choose traditional financing may likewise be able to acquire it for a produced home through the Freddie Mac House Possible home mortgage program. Certified borrowers might be able to select between fixed-rate home loans (15, 20 and thirty years) and 7/1 or 10/1 variable-rate mortgages. You may be able to secure a loan with as little as 3 percent down, and, in some cases, you can use gift or grant money to help cover your down payment.

You can get a loan through this program to purchase a manufactured or modular home and put it on land you currently own, purchase both the home and the land at the same time or re-finance a home you plan to transfer to land that you own. As with conventional VA mortgage, lending institutions can provide up to 100 percent funding on made home loans through the program. You'll require what's called an affidavit of affixture, which proves that the property is connected to land that you own and satisfies certain local and VA requirements. Loan terms can range from: 15 years plus 32 days for land acquired for a produced home you currently own.

23 years plus 32 days for a double-wide manufactured home. 25 years plus 32 days for a loan on a double-wide manufactured home and land. A chattel loan is an unique kind of individual residential or commercial property loan that can be used to buy a mobile house. These loans are developed for financing costly vehicles like aircrafts, boats, mobile houses or farm devices, where the property ensures the loan. Even if you don't own the arrive at which your home will be situated, you might be able to protect financing with a belongings loan. As a result, they are a popular loan option for buyers who plan to lease a lot in a produced house community.

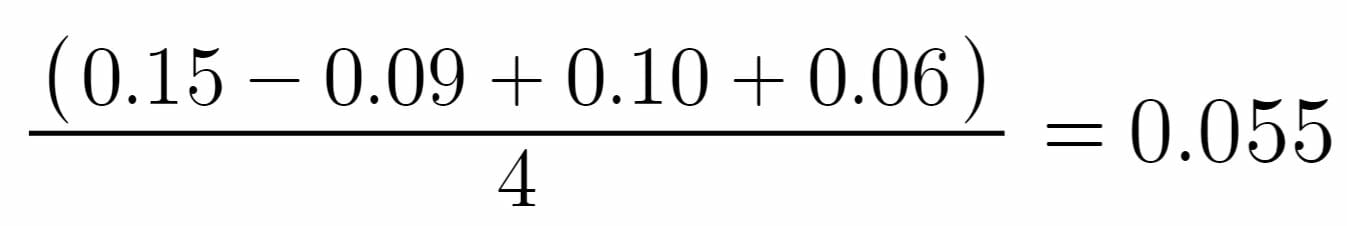

Department of Veterans Affairs (VA) and the Rural Real Estate Provider (RHS) through the U.S. Department of Farming. However while you may have the ability to discover lending institutions that provide both chattel loans and traditional home loans, the 2 types of loans vary in a few methods. For beginners, effects loans usually have higher interest rates 0. 5 to 5 portion points greater typically than standard home mortgage rates. Effects loans have shorter terms than traditional home loans, which can translate to greater regular monthly payments but might likewise help you to pay off your financial obligation earlier. On the plus side, the closing process is generally much faster and less restrictive with belongings loans than the closing process you would experience with a conventional mortgage.

Personal loans are flexible loans that you can use for nearly any purpose. However, personal loan interest rates tend to be higher than those of other types of loans, such as mortgages or vehicle loans. The trade-off is that you don't need to offer any collateral which indicates you will not lose your home if you default and the application process tends to be shorter and involves less documentation. Another important advantage of individual loans over home mortgages is that they're generally cheap or complimentary to set up, states Steve Sexton, CEO of Sexton Advisory Group. "There's no pricey title, escrow, or appraisal costs.

If you see a lender offering a personal loan large enough for you to finance a mobile house, it might be a great way to borrow the cash that you need. If you're questioning how to purchase a mobile house and get the very best financing, there are a couple of actions you should follow first. Whenever you make an application for any type of funding, a lender will consider your credit as part of your loan application. Clean credit histories and solid credit rating make it simpler to secure loans and receive much better rates and terms from loan providers. If you discover errors when you inspect your credit reports, you can dispute them with the appropriate credit bureau Experian, Trans, Union or Equifax.

What Does What Does It Mean To Finance Mean?

This can conserve you thousands of dollars throughout the loan. When you're seeking a loan to finance a mobile home, the stability of the property being funded is crucial, says Sexton. If you own the land and your mobile home has had the axle and wheels eliminated, that makes it less likely for the customer to get and move, more lending institutions are open to financing the property. If you prepare to steve grauberger lease a plot for your home, you'll be eligible for fewer loans than if you plan to acquire the land the home will be positioned on.

For instance, if you want to buy a double-wide manufactured home that costs $100,000 or more, you won't be qualified for an FHA loan. In addition, older mobile houses may not qualify for funding at all. All lending institutions have particular financing requirements based upon the type and worth of your home. Select the kind of loan (FHA, standard, belongings, personal) that you'll utilize and compare various loan providers' offerings. Rates and fees can differ commonly in between lenders, so make the effort to look around. Try to find a loan that has low fees and low interest rates so you can spend just possible over the life of the loan.

In addition, browsing for funding options early will assist ensure that there is a loan readily available to help you make the purchase. You'll want to make sure that your application is as complete and transparent as possible. In addition, lots of lenders need a deposit, so be prepared to make a payment when you complete your application. Having all of your application products on hand and finishing the entire application will improve your chances of qualifying and keep the process running smoothly. Similar to any loan, your loan's rate of interest will vary with a number of elements. Your credit report, your down payment size, the kind of home and whether you're buying land in addition to the mobile house will impact the amount that you pay.